Buying your first home can feel frustrating when the numbers don’t line up the way you expected. You may know you’re ready but finding something that fits your life and your budget is the hard part.

That’s where townhomes come in.

Townhomes are becoming a bigger part of today’s housing supply, and that shift is opening doors for first-time buyers in a way we haven’t seen in years. That’s because they offer a more realistic path to step into homeownership without stretching yourself too thin, especially in a market where affordability can still feel tight.

There Are More Townhomes To Choose From

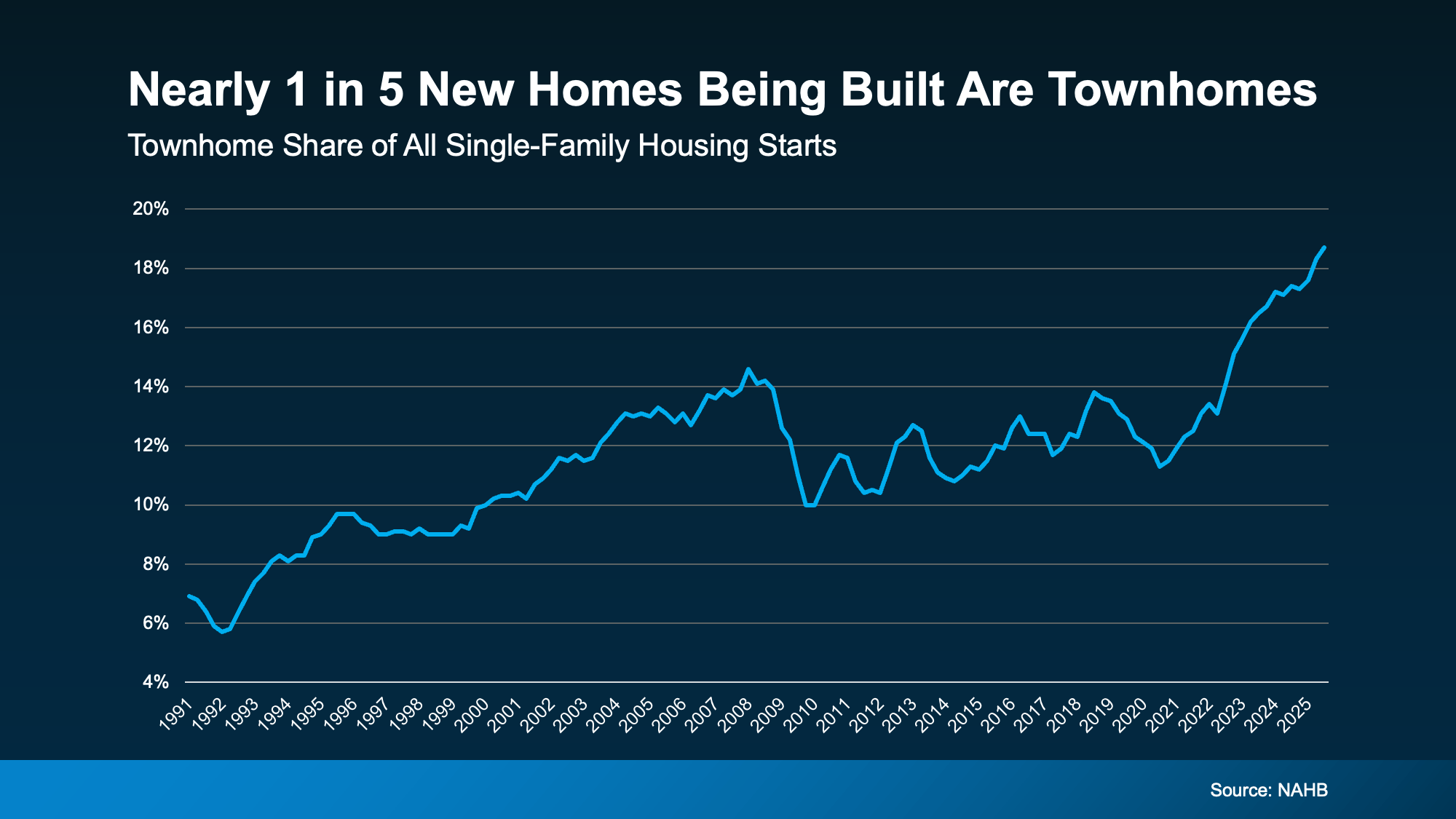

Builders are building more townhomes than they have in decades. In fact, when you look at data from the National Association of Home Builders (NAHB), nearly 1 in 5 new single-family homes being built today is a townhome. That's the highest share on record (see graph below):

To put that in perspective, just a decade ago, townhomes made up closer to 1 in 10 new construction homes.

That gives today’s buyers far more townhome options than they had in the past. And that’s a really good thing.

Townhomes are one of the best ways for first-time buyers to finally get their foot in the door. And seeing that there’s more available for sale means one thing: you may have more opportunity to break into the market than you think.

Here’s why they’re such a popular choice for buyers like you.

Townhomes Tend To Be More Affordable

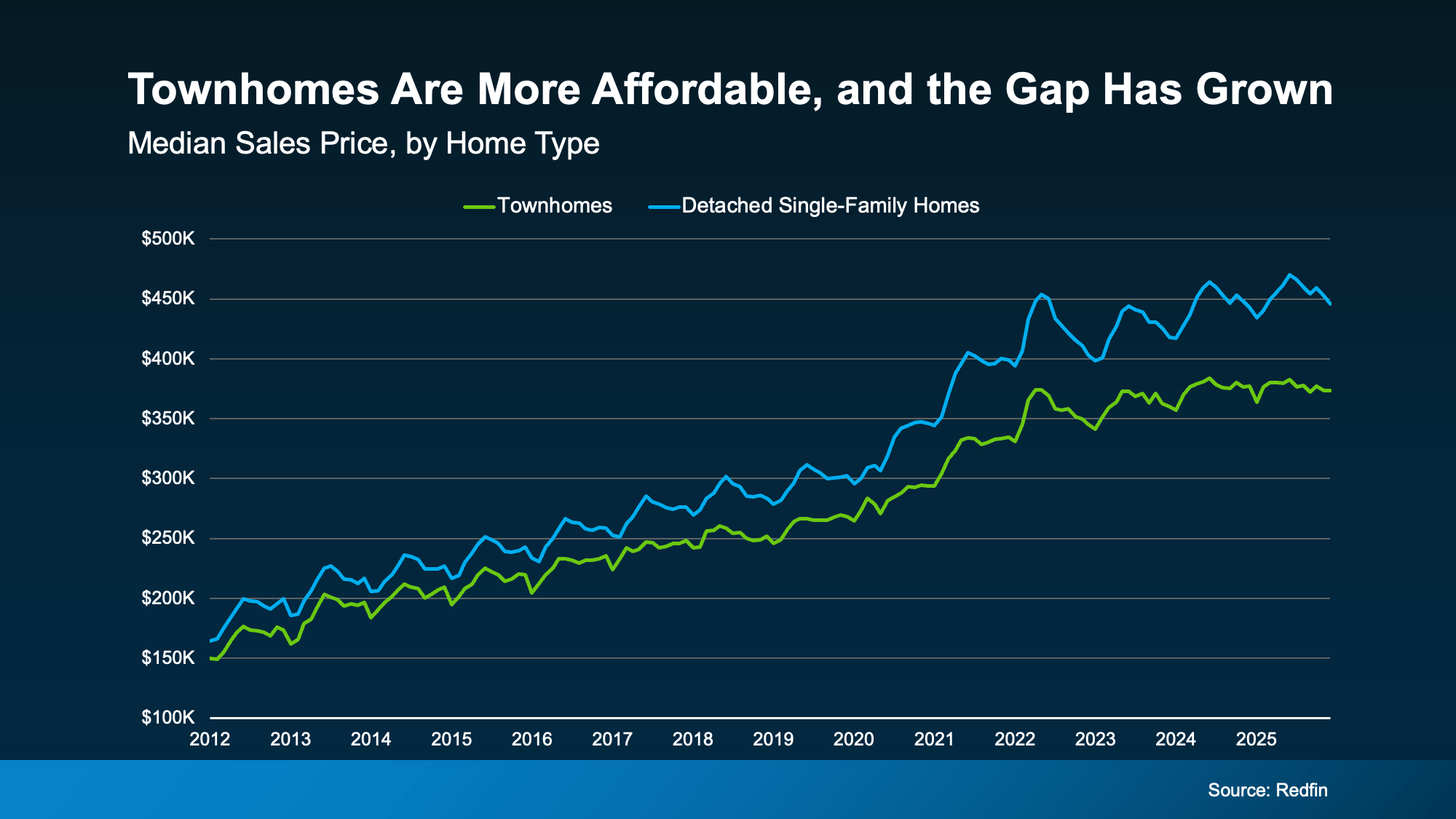

While prices vary by market, Redfin data shows townhomes are typically priced lower than detached single-family homes nationally. And that gap has grown in recent years as the supply of this type of home has grown too (see graph below):

There are two main reasons you may find a better deal on a townhome today.

There are two main reasons you may find a better deal on a townhome today.

Reason #1: Size

Townhomes are usually smaller by design. Most modern townhomes fall in the 1,300–1,500 square foot range, which helps keep prices, and monthly payments, lower. Basically, it works like this. Since they usually have a smaller footprint, they’re cheaper to build, and that makes them less expensive to buy, too. Ali Wolf, Chief Economist at NewHomeSource, explains how this helps buyers:

“With the high cost of housing across the country, townhomes have emerged as a vital, more accessible entry point into homeownership. They are often priced lower than detached houses, offering buyers – especially first-timers, young professionals, and those downsizing – the chance to build equity without breaking the bank.”

Reason #2: Builder Motivation

And here’s another thing working in your favor. With more inventory than in recent years, homebuilders are motivated to sell what they’ve already built.

So, many may be more willing to negotiate, whether that means price flexibility, closing cost help, or potentially throwing in upgrades. According to the National Association of Realtors (NAR):

“. . . home builders say they’re ready to attract more first-time home buyers. They’re responding to affordability pressures through lower cost homes and builder incentives. About 40% of builders cut prices on newly built homes at the end of last year . . . Roughly two-thirds of builders also offered additional incentives, like mortgage rate buydowns.”

Bottom Line

If buying your first home feels just out of reach, the right option might not be a different timeline. It might be a different type of home.

If you want to talk through whether a townhome makes sense for you or see what’s available in our area, let’s connect.